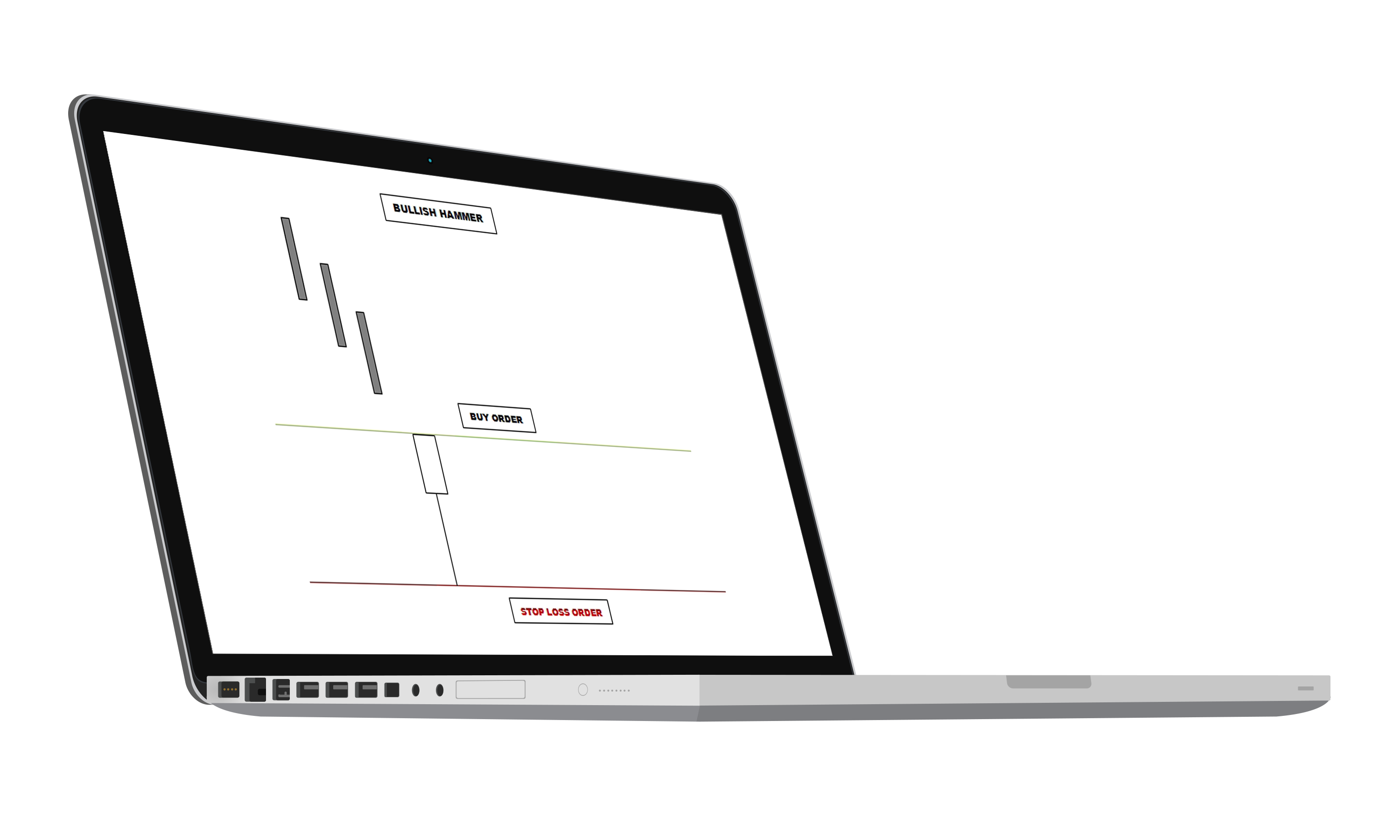

Since it is hammering out of a bottom, this pattern, known as a Hammer, appears at the bottom of a trend or during a downturn. It is a single candlestick pattern with a small body at the top of its daily trading range or very close to it and a long lower shadow.

The Hammer's body should be compact. The lower shadow shouldn't be any shorter than a typical candlestick, but it should be at least twice as long as the body. It is preferred that the upper shadow be absent or extremely small. The bottom of the Hammer's body need to be lower than the bases of the two black candlesticks that come before it.

The Bullish Hammer appears in a downtrend and it sells off sharply following the market open. The market almost reaches its day's high after the downturn stops. Evidently, the market is unable to move forward on the selling side. The earlier pessimistic emotion is diminished by this finding, which causes short traders to become more apprehensive about their bearish bets. The position for the bulls appears considerably better if the Hammer's body is white.

The top of the Hammer's body is referred to as the confirmation level. For confirmation, prices must cross over this level.

The previous low is referred to as the stop loss level. The stop loss is triggered if, after the BUY, prices fall instead of rising and close below or make two successive daily lows below the stop loss level without the appearance of a bearish pattern.

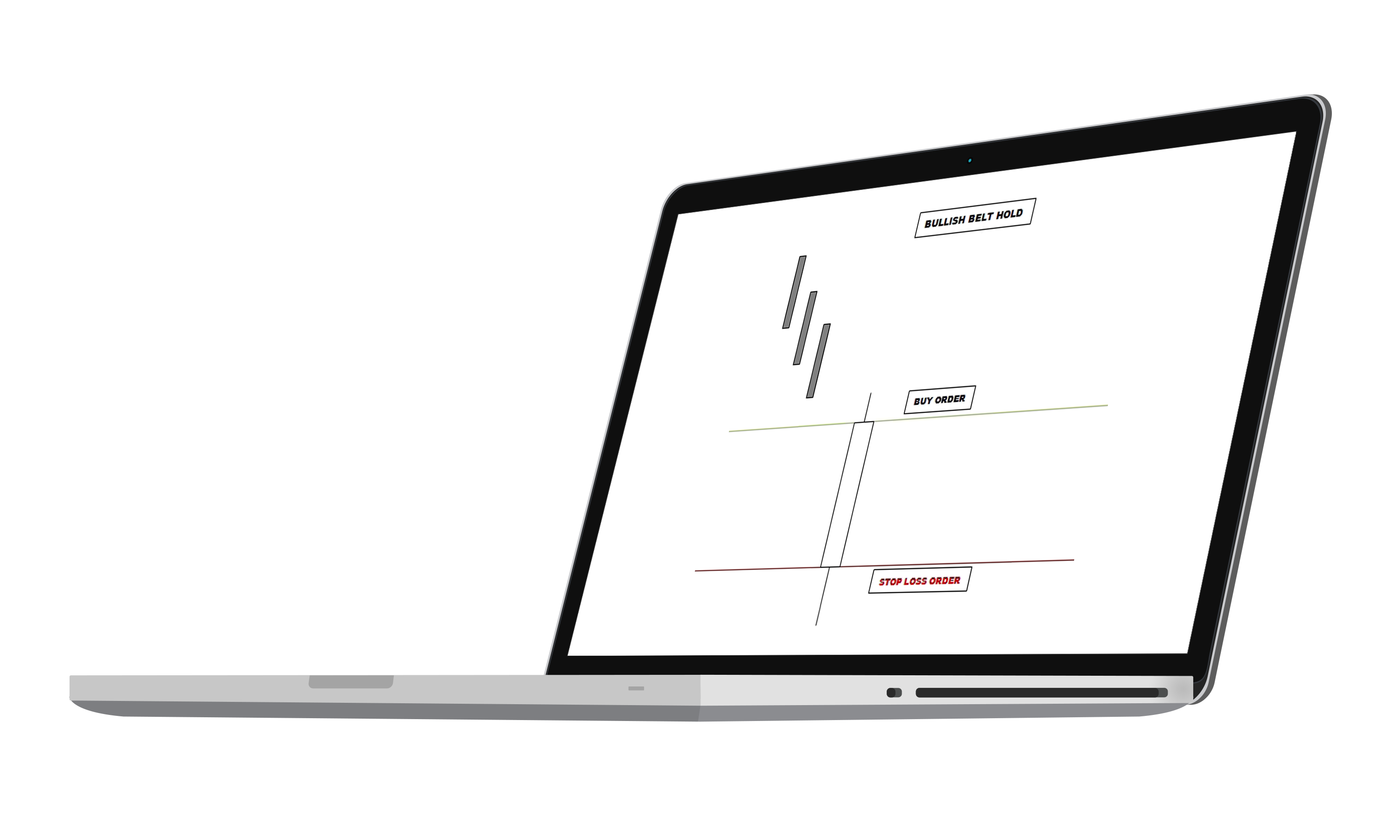

A Bullish Belt Hold is a single candlestick pattern that appears during a decline and is essentially a White Opening Marubozu. It starts off at the day's low before beginning a rise against the market's main trend throughout the day. The rally eventually comes to a conclusion with a close near the day's high, leaving a slight shadow on top of the candle. Longer bodies will provide considerably more resistance to the tendency if the Belt Hold is characterised by it.

In a Bullish Belt Hold, a white opening marubozu or a white marubozu (without an upper or lower shadow) should be visible, and it should open lower than the two black candlesticks that came before it.

With a sizable gap in the direction of the current downturn, the market opens lower. As a result, the opening price gives the impression that the downward trend will continue. After the market opens, though, things quickly shift, and the market starts moving the other way. The short traders are quite concerned about this, which prompts them to close out numerous positions. This could change the trend and trigger a bullish rise.

The final close is referred to as the confirmation level. For confirmation, prices must cross over this level.

The stop loss level is defined as the last low. Following the BUY, if prices go down instead of going up, and close or make two consecutive daily lows below the stop loss level, while no bearish pattern is detected, then the stop loss is triggered.

This pattern, which arises during a decline, is characterised by a big white body enveloping a smaller black body that came before it. The black body's shadows may not always be completely engulfed by the white body, which also completely engulfs the body itself. This significant bottom reversal signal is present.

Bullish engulfing doesn't care how long the first black candlestick is as long as it closes. Also, it might be a Doji. The second one must be a standard or long white candlestick, though. The white body should be longer than the earlier black body, regardless of whether the body tops or body bottoms of the two candlesticks are at the same level.

Although the market is in a slump, the presence of a black body on the first day results in less selling activity. The market debuts at fresh lows the next day. It appears as though there would be more bearish trade, but as the day goes on, the downtrend loses steam and the bulls gain control. Selling pressure finally gives way to purchasing pressure, and the market ends higher than it did at the day's opening. It is no longer in a downtrend.

The final close is referred to as the confirmation level. For confirmation, prices must cross over this level.

The previous low is referred to as the stop loss level. The stop loss is triggered if, after the BUY, prices fall instead of rising and close below or make two successive daily lows below the stop loss level without the appearance of a bearish pattern.

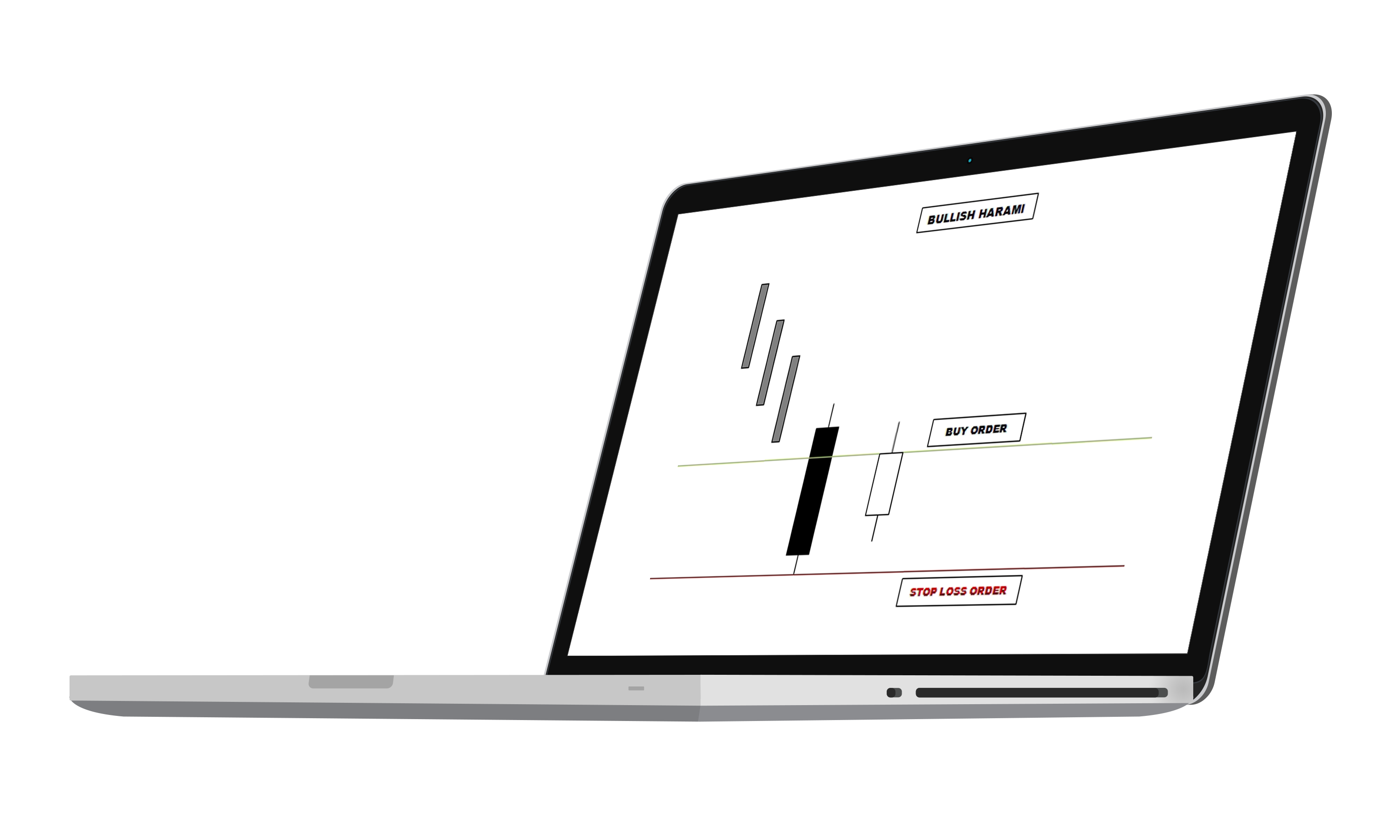

This pattern consists of a small white body that lies entirely within the black body's viewing range and a black body. If the pattern's outline is drawn, it resembles a pregnant woman. There is no chance behind this. An ancient Japanese word for "pregnant" is "harami." The small candlestick represents "the baby," and the black candlestick serves as "the mother."

The pattern consists of two candlesticks, with the black candlestick on the first day engulfing the white candlestick on the second day. It must be a standard or long black candlestick for the first one. The white body should be smaller than the earlier black body, regardless of whether the body tops or body bottoms of the two candlesticks are at the same height.

The Bullish Harami indicates that the market's health is uneven. The market is in a decline with a negative attitude, and there has been significant selling as indicated by a dark body, which strengthens the bearishness. The short traders become concerned when prices start the following day higher or at the close of the day before. The price rises higher as a result of many short positions being covered. The ascent is slowed down by the latecomers who short the trend they first missed. Consequently, a little white body develops. Given that the second day's real body is small and the bearish power is waning, this could indicate a trend reversal.

The last close or the midpoint of the first black body, whichever is higher, is considered the confirmation level. For confirmation, prices must cross over this level.

The lowest of the previous two lows is used to define the stop loss level. The stop loss is triggered if, after the BUY, prices fall instead of rising and close below or make two successive daily lows below the stop loss level without the appearance of a bearish pattern.

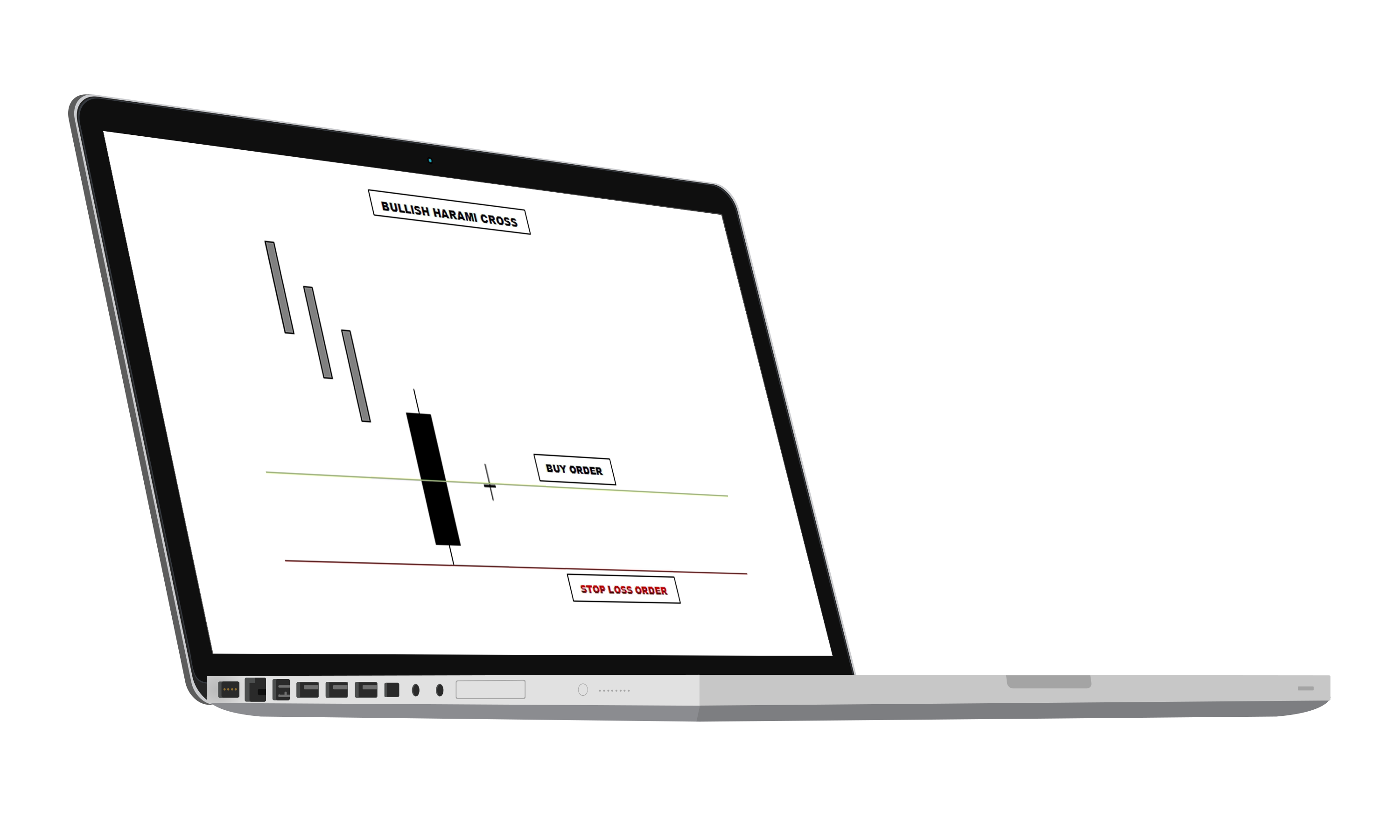

Even more significant than a typical Bullish Harami, this is a significant bullish reversal pattern. The outline resembles a pregnant lady once more, just like in the Bullish Harami Pattern. But now the infant is a Doji. In essence, the pattern is represented by a black body that is immediately followed by a Doji that lies entirely inside the black body's previous range.

The first black candlestick's body engulfs the second Doji's body to form the Bullish Harami Cross, which comprises of two candlesticks. The first candlestick's body could be brief.

The market is in a decline and has a dominant bearish attitude. A dark body on the first day's candlestick adds to the bearishness. The prices open the following day higher than the previous day's closure or at that time. Since many short positions are covered as a result of the short traders' concern, the price continues to increase. Additionally, the day ends at the opening price, indicating that traders lacked decisiveness. The likelihood of a trend change and subsequent reversal is amplified by the rising level of ambiguity and ambivalence.

The initial candlestick in the Bullish Harami Cross pattern may be short. Due to this, the confirmation level relative to the first candlestick's body length changes:

The lowest of the previous two lows is used to define the stop loss level. The stop loss is triggered if, after the BUY, prices fall instead of rising and close below or make two successive daily lows below the stop loss level without the appearance of a bearish pattern.

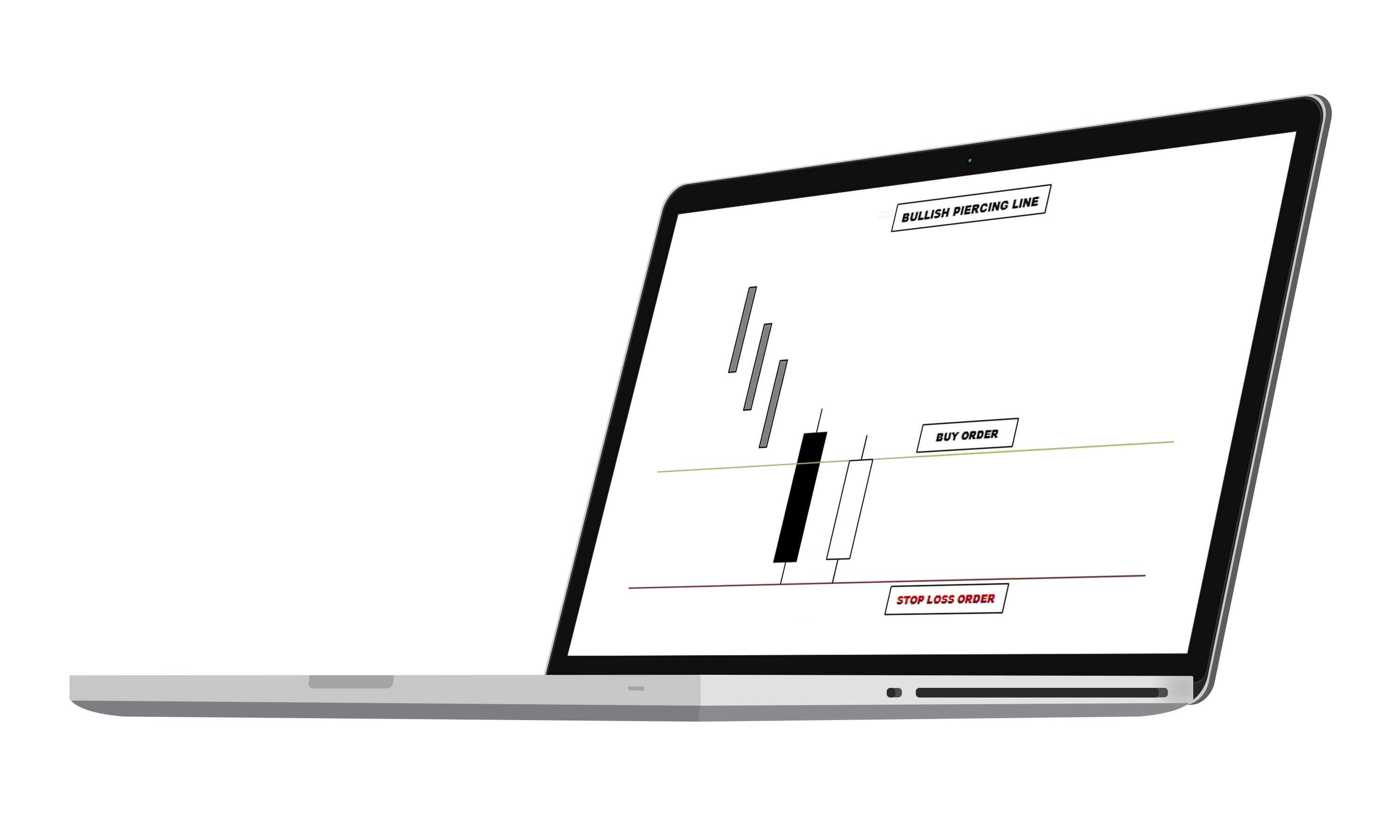

Two candlesticks form a bottom reversal pattern in this instance. On the initial day of a downtrend, a black candlestick occurs. The second day begins with a gap down, opens at a new low, and closes more than halfway into the first black body, causing a strong white candlestick to form.

Bullish Piercing Line patterns begin with a standard or long black candlestick on the first day. The second day should begin substantially below the preceding day's closing and end more than halfway within the body of the previous black candlestick. The close of the second day must, however, remain within the first day's body.

The market is trending downward. The initial black body supports this idea. The market gaps lower the following day, indicating that the bearishness is still present. Bulls decide to seize the lead following this extremely negative opening. As the market soars as the day comes to a close, prices start to rise, causing the closing to be significantly higher than the day before. The bears are currently losing faith and rethinking their short bets. The prospective purchasers begin to speculate that new lows would not hold and that it might be appropriate to take long positions.

The final close is referred to as the confirmation level. For confirmation, prices must cross over this level.

The previous low is referred to as the stop loss level. The stop loss is triggered if, after the BUY, prices fall instead of rising and close below or make two successive daily lows below the stop loss level without the appearance of a bearish pattern.

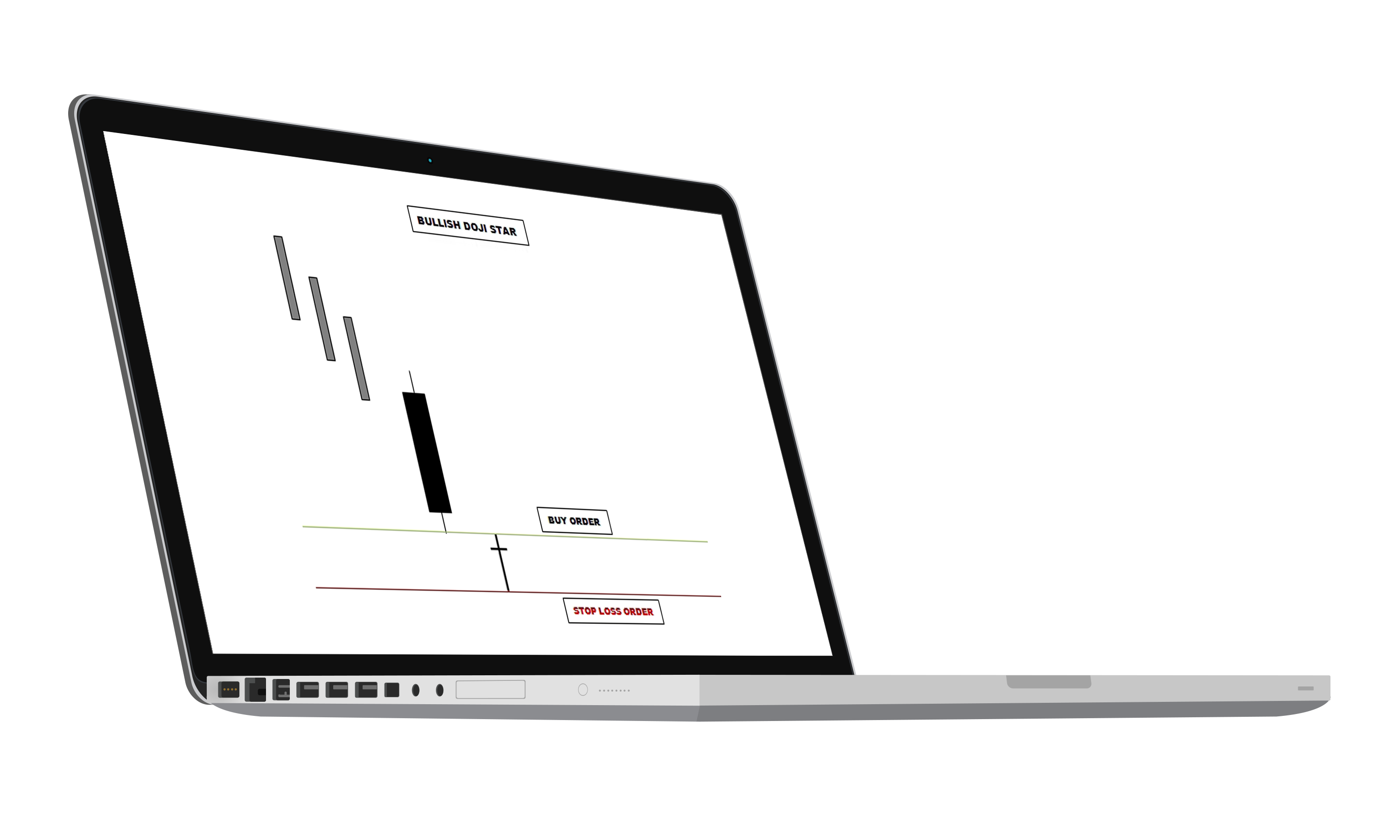

This pattern signals a change in trend when it shows up during a downward trend. It consists of a Doji with a downward gap at the entrance and a black candlestick. The pattern is known as "Bullish Dragonfly Doji" when the Doji takes the shape of an umbrella, and "Bullish Gravestone Doji" when the Umbrella is inverted. Regardless of the Doji's shape, all of these patterns are grouped together under the moniker "Bullish Doji Star" in this instance.

A standard or long black candlestick should be the first element of the Bullish Doji Star. The next thing must be a Doji gapping down.

Strong black candlestick further underscores the market's decline. The trading is in a narrow range the following day as it starts lower with a gap down. A Doji forms when the day ends at the price it began at. During the downturn, bears were in charge, but the appearance of a Doji Star, which indicates that the bulls and the bears are in harmony, suggests a change presently. The negative vibe is fading away. The odds of a bear market persisting are not good.

The middle of the distance between the Doji and the preceding candlestick is known as the confirmation level. For confirmation, prices must cross over this level.

The lowest of the previous two lows is used to define the stop loss level. The stop loss is triggered if, after the BUY, prices fall instead of rising and close below or make two successive daily lows below the stop loss level without the appearance of a bearish pattern.

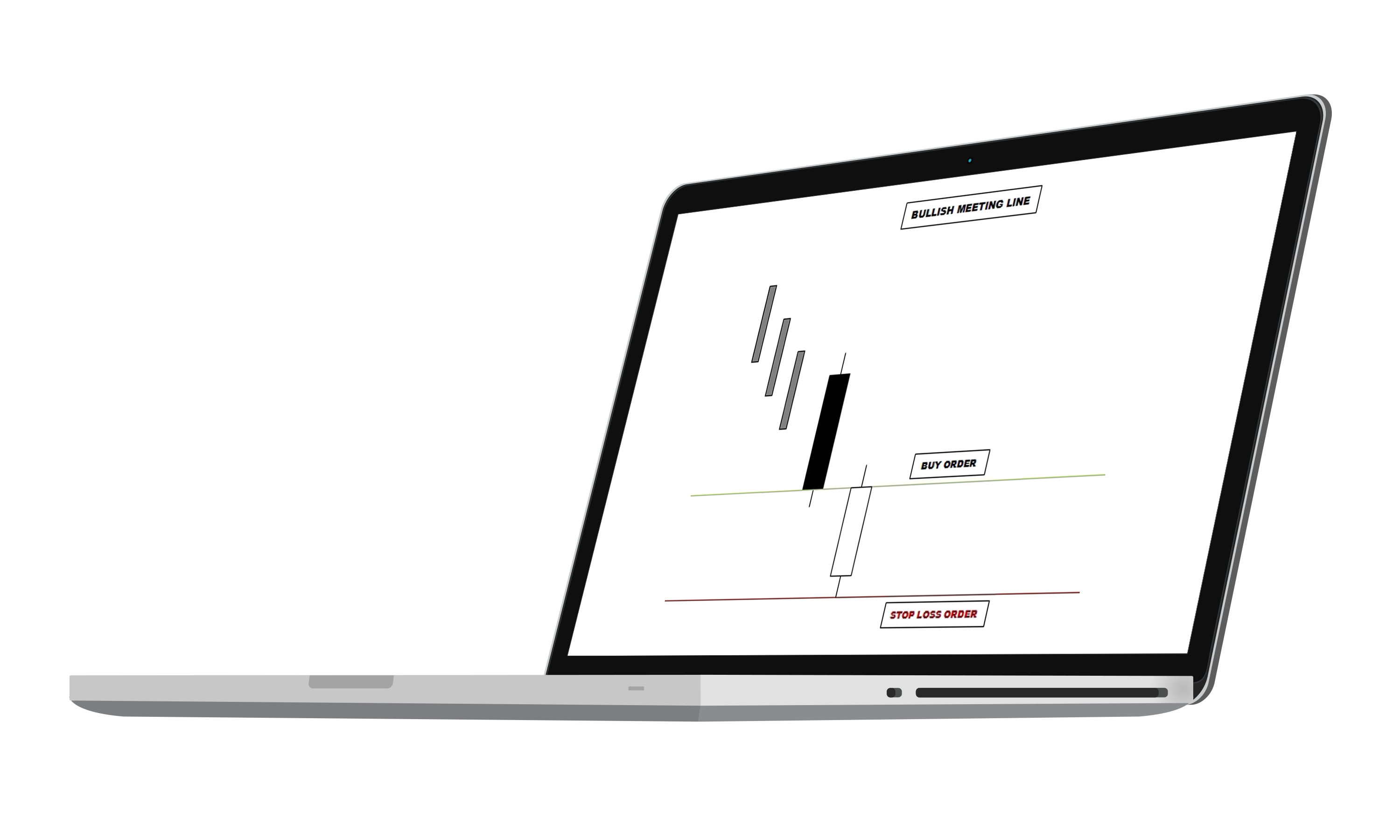

This pattern appears when the trend is downward. The white candlestick, which opens dramatically lower and closes at the same level as the black candlestick from the first day, comes after the black candlestick. It resembles the Piercing Line design. The quantity that rebounds on the second day varies, though. The Bullish Meeting Line's second day closes the same as the first day, whereas the Piercing Line's second day closes above the first day's body's halfway. As a result, the bottom reversal at the Piercing Line is more noteworthy. However, the Bullish Meeting Line also merits regard.

The two non-short candlesticks that make up the bullish meeting line are black and white, respectively. Both days' closing prices ought to be equal or nearly equal.

This pattern's occurrence indicates a standoff between bulls and bears. When a substantial black candlestick forms, the market is in a decline, and this further confirms the trend. The bears gain confidence with the next day's much lower opening. Then the bulls launch a counterattack, driving prices higher and bringing the close into line with the previous close (or very near to it). Now the downtrend has been broken.

The final close is referred to as the confirmation level. For confirmation, prices must cross above this level.

The previous low is referred to as the stop loss level. The stop loss is triggered if, after the BUY, prices fall instead of rising and close below or make two successive daily lows below the stop loss level without the appearance of a bearish pattern.

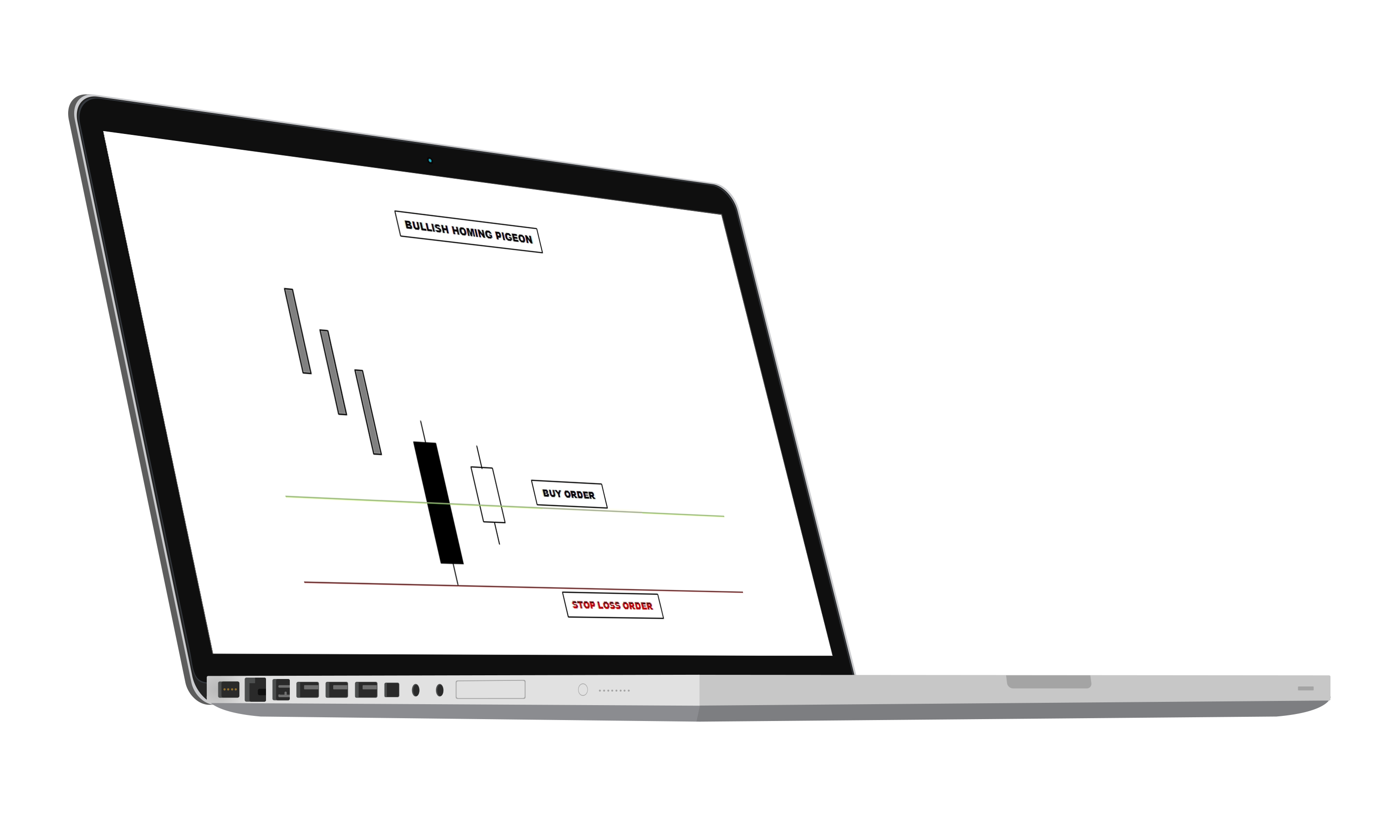

In this design, a somewhat lengthy black body surrounds a smaller black body. In contrast to the Harami pattern, both bodies are black.

Two black candlesticks make up the Bullish Homing Pigeon, in which the first day's black body engulfs the second day's black body. It must be a standard or long black candlestick for the first one. The second day's body should be smaller than the first day's body, regardless of whether the body tops or body bottoms of the two candlesticks are at the same level.

The pattern serves as a discrepancy indication. In a market that is in a downtrend, the first day's black body serves as a reflection of the first instance of significant selling. However, a smaller body that shows up on the second day indicates that the sellers' strength and zeal have waned, pointing to a potential trend reversal.

The last close or the midpoint of the previous black body, whichever is higher, is considered the confirmation level. For confirmation, prices must cross over this level.

The lowest of the previous two lows is used to define the stop loss level. The stop loss is triggered if, after the BUY, prices fall instead of rising and close below or make two successive daily lows below the stop loss level without the appearance of a bearish pattern.

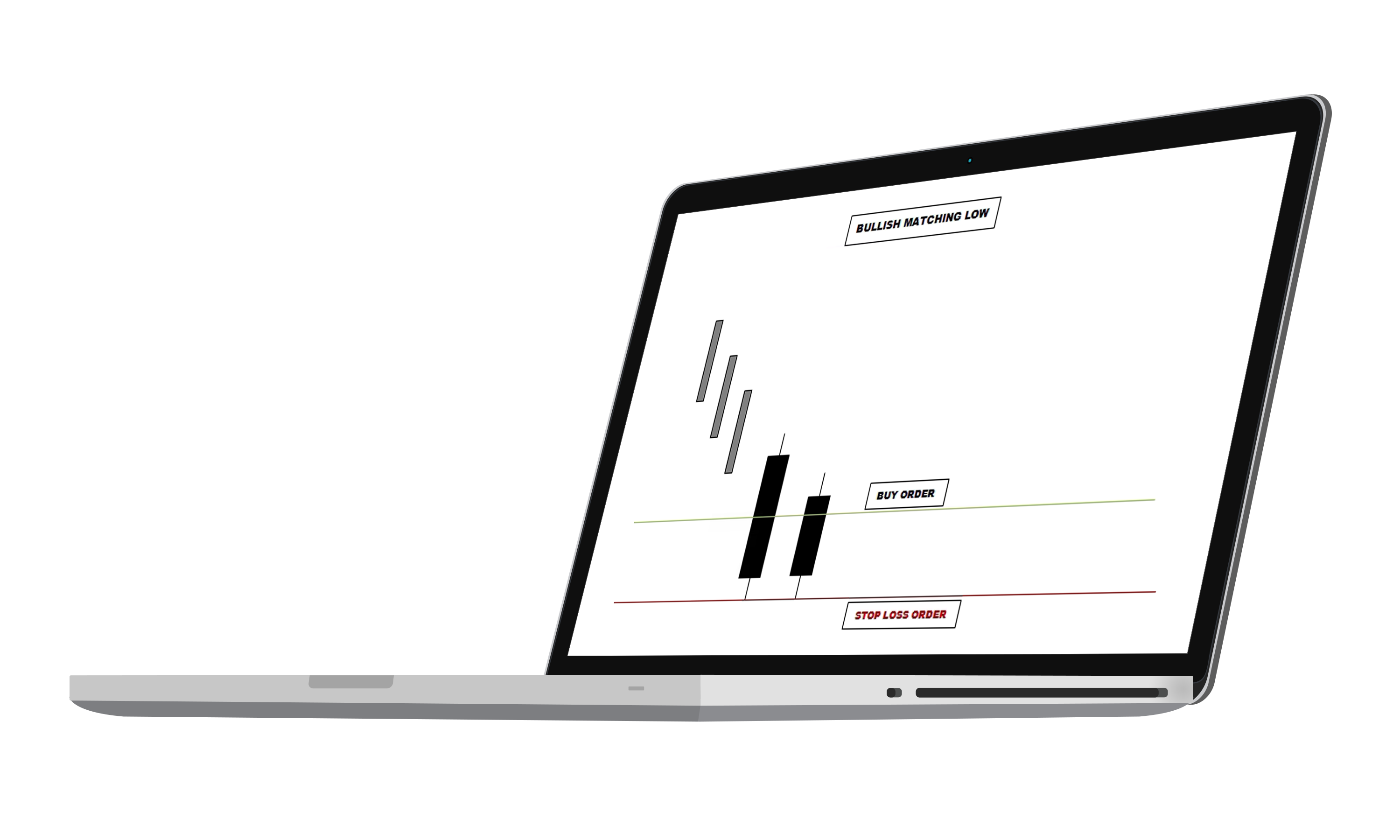

When two black days with equal closes happen in a downward trend, this pattern develops. Even though the new low was tested and there was no follow-through, the matching low signal implies a bottom has been created, which is a sign of a strong support price.

Two black candlesticks form the Bullish Matching Low. The first candlestick should be typical or long in length. It is ideal for both candlesticks to close at the same point.

Another significant black day serves as evidence that the market has been declining. The price is the same when it closes on the next day after opening higher and trading even higher. This is a sign of temporary support and will worry the bears greatly. The fact that both days close at the same level rather than the daily trading activity serves to represent the psychology of the market.

The middle of the first black body is referred to as the confirmation level. For confirmation, prices must cross over this level.

The lowest of the previous two lows is used to define the stop loss level. The stop loss is triggered if, after the BUY, prices fall instead of rising and close below or make two successive daily lows below the stop loss level without the appearance of a bearish pattern.

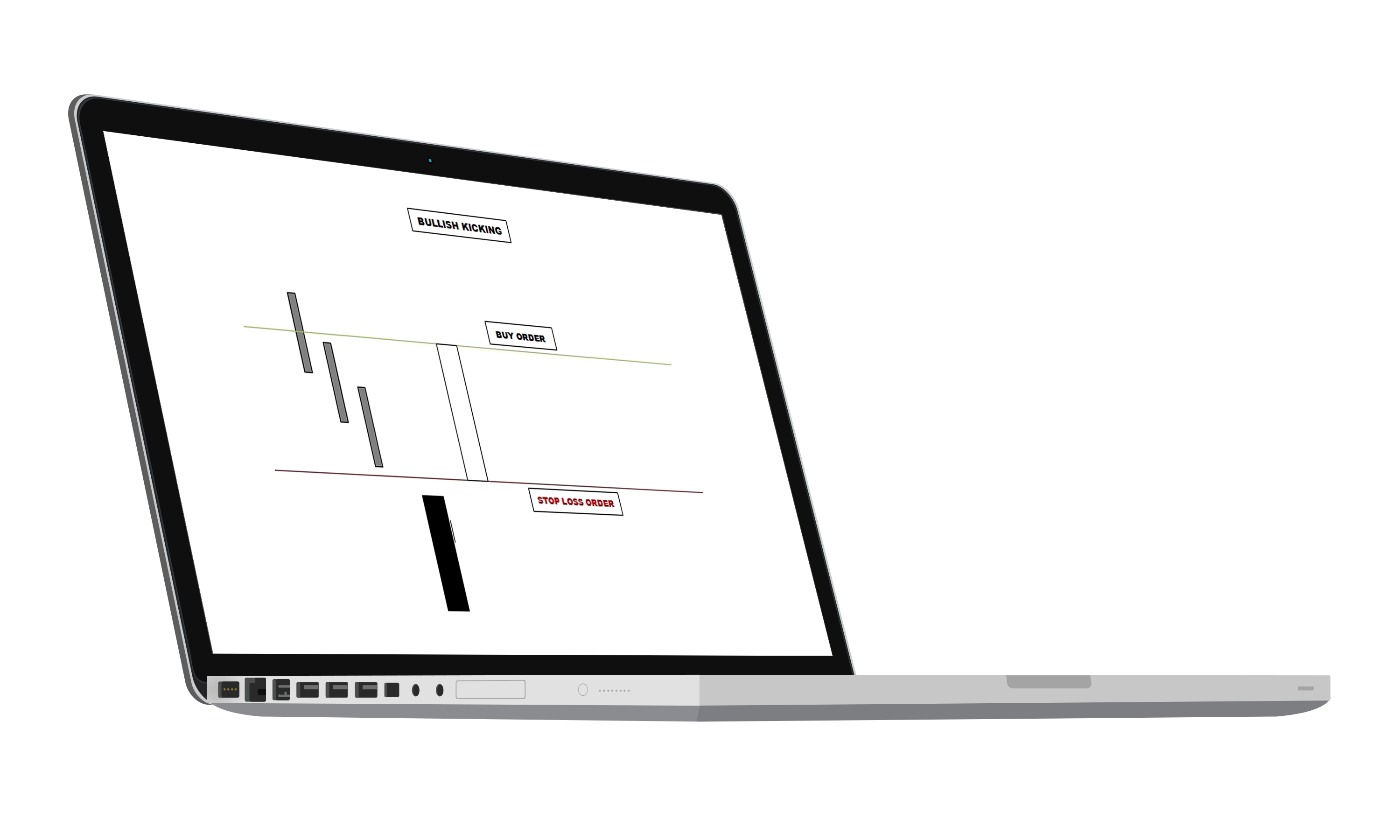

A black Marubozu appears first in this design, followed by a white Marubozu. Following the black Marubozu, the market opens higher than it did at the start of the previous session, creating a space between the two candlesticks.

A body gap should be present between the black and white Marubozus of the Bullish Kicking. We also accept a null body gap and normal or lengthy candlesticks. In this fashion, the continuation pattern known as the Bullish Separating Lines Pattern (which is not discussed here) is also incorporated in a modified style as a reversal pattern.

The pattern is a potent indicator that the market is rising. A strong black candlestick (or a black Marubozu) on the first day furthers the bearishness of the chart, which appears to be downtrending. Prices open at or above the previous day's open the following day, creating a gap. The bulls are compelled to behave by this significant gap. A white candlestick is formed by the market heads rising (or a white Marubozu).

The final close is referred to as the confirmation level. For confirmation, prices must cross over this level.

The previous low is referred to as the stop loss level. The stop loss is triggered if, after the BUY, prices fall instead of rising and close below or make two successive daily lows below the stop loss level without the appearance of a bearish pattern.

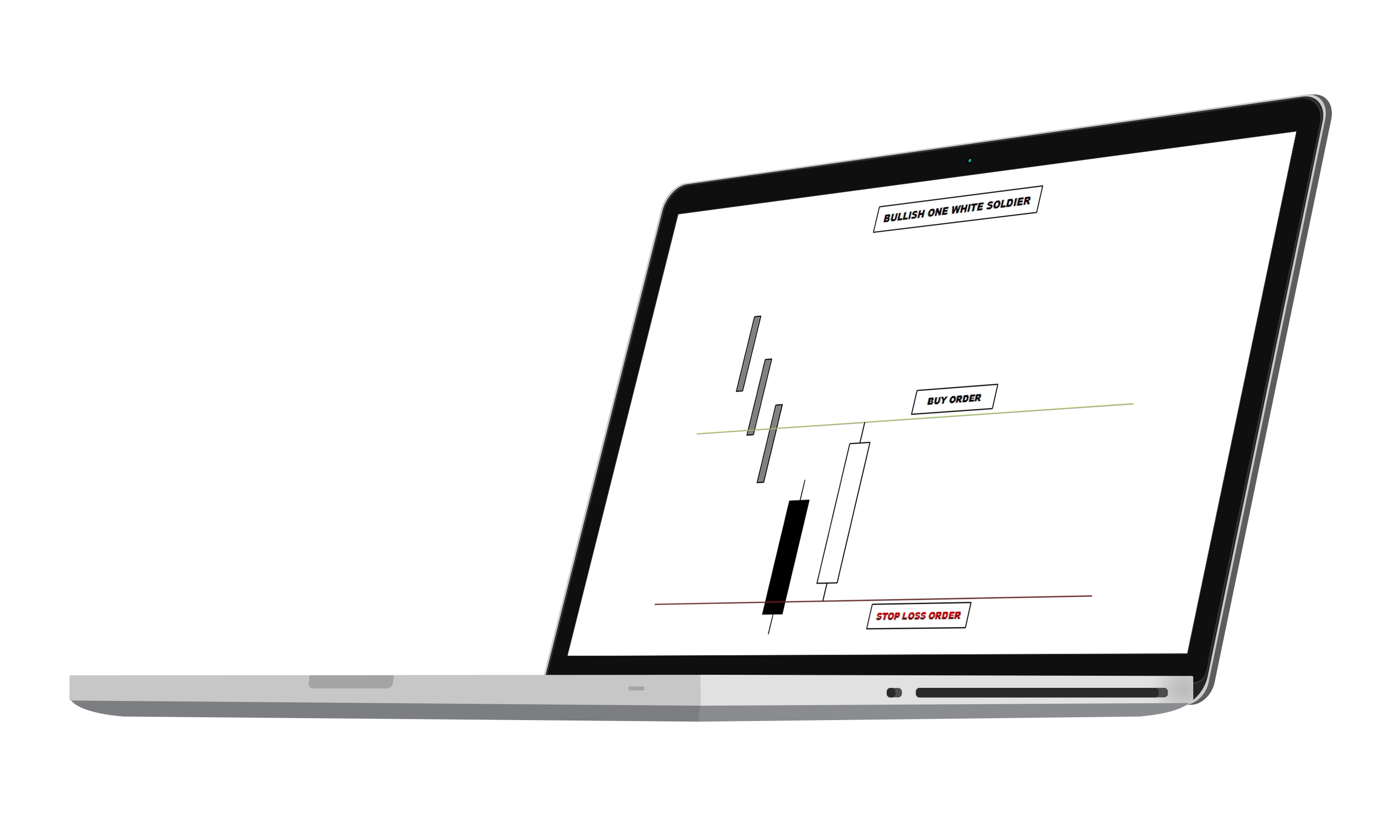

A black candlestick and a white candlestick that both open and close above the previous day's close make up this pattern, which usually occurs during a decline. The Bullish Harami pattern resembles the pattern in appearance. The second day's closing price is higher, which prevents the previous black body from engulfing the white body. This is the only change.

The black candlestick is followed by the white candlestick in The Bullish One White Soldier. The candlesticks shouldn't be too short in length. The second day begins above the previous day's close, and the previous day's closure crosses over the first day's opening price.

The strong black candlestick that was shown on the first day of a downturn intensifies the previously existing bearishness. The short traders are frightened as the second day opens higher than the closing. Prices increase until the previous day's opening is crossed by the closing. It is no longer in a downtrend. If prices continue to rise during the ensuing days, a significant trend reversal occurs.

The final close is referred to as the confirmation level. For confirmation, prices must cross over this level.

The previous low is referred to as the stop loss level. The stop loss is triggered if, after the BUY, prices fall instead of rising and close below or make two successive daily lows below the stop loss level without the appearance of a bearish pattern.

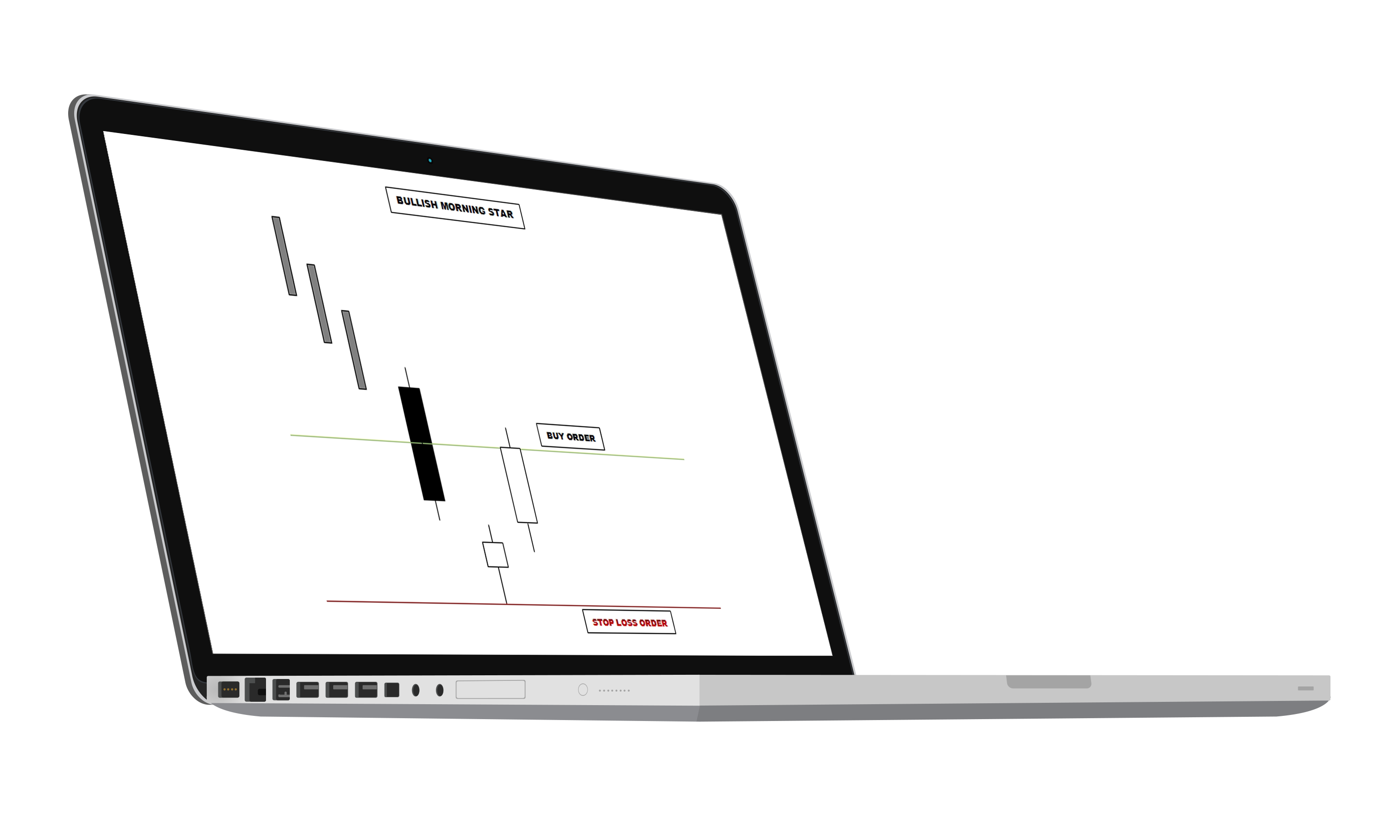

This three candlestick pattern denotes a significant bottom reversal. It is made out of a short candlestick that typically gaps down to resemble a star, followed by a black candlestick. The third white candlestick, whose close is deep within the black body of the first session, follows. This bottom pattern has significance.

A short candlestick (white or black) that opens with a gap down should follow the black candlestick that initiates the Bullish Morning Star. The third-day white candlestick should open at or higher than the second candlestick's lowest level of body, and it should close well inside the black candlestick that first emerges in the pattern. According to the other candlesticks in the pattern, the height at which this candlestick must close is determined. The conclusion of the third day must fall halfway between the beginning of the first day and the lowest body level of the second day.

A downward trend is currently in motion, and the black candlestick confirms that the downward trend will continue. The short candlestick that creates a gap signals that bears are still trying to drive the stock lower. The second day's tight price movement between open and close, however, reveals uncertainty. A white body inhabits the black body of the first day on the third day. A noteworthy tendency has emerged.

The final close is referred to as the confirmation level. For confirmation, prices must cross over this level.

The lower of the previous two lows is used to define the stop loss level. The stop loss is triggered if, after the BUY, prices fall instead of rising and close below or make two successive daily lows below the stop loss level without the appearance of a bearish pattern.

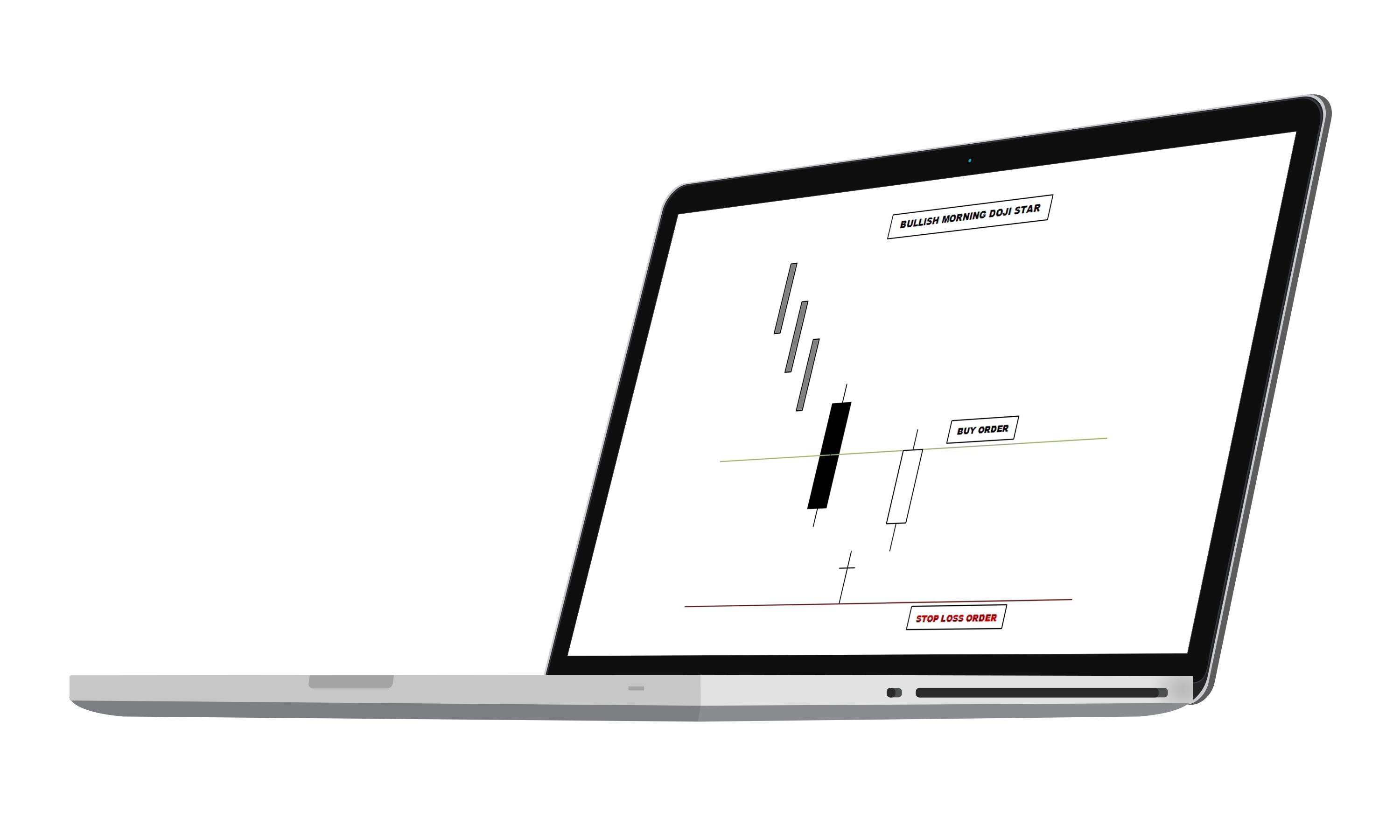

This three-candlestick pattern denotes a significant bottom reversal. It is made out of a Doji, which customarily gaps down to form a Doji Star, followed by a black candlestick. The third white candlestick, whose close is deep within the black actual body of the first session, follows. This bottom motif is recognisable.

Beginning with a black candlestick, the Bullish Morning Doji Star should end with a doji that results in a gap opening lower than the closing of the first day. The white candlestick that makes up the pattern's third day has an initial price that is equal to or higher than the Doji, and it should close well into the black candlestick that first appears in the pattern. According to the other candlesticks in the pattern, the height at which this candlestick must close is determined. The conclusion of the third day must fall halfway between the beginning of the first day and the lowest body level of the second day.

The black candlestick confirms the continuance of the downtrend, which has already been established. The emergence of the Doji that creates a gap shows that bears are still attempting to drive the price lower. The price action's tight range between open and close, meanwhile, also reveals uncertainty. The candlestick's body is higher on the third day than it was on the first, attempting to make up some lost ground from the first day's downturn. There has been a big trend reversal.

The final close is referred to as the confirmation level. For confirmation, prices must cross over this level.

The lowest of the previous two lows is used to define the stop loss level. The stop loss is triggered if, after the BUY, prices fall instead of rising and close below or make two successive daily lows below the stop loss level without the appearance of a bearish pattern.

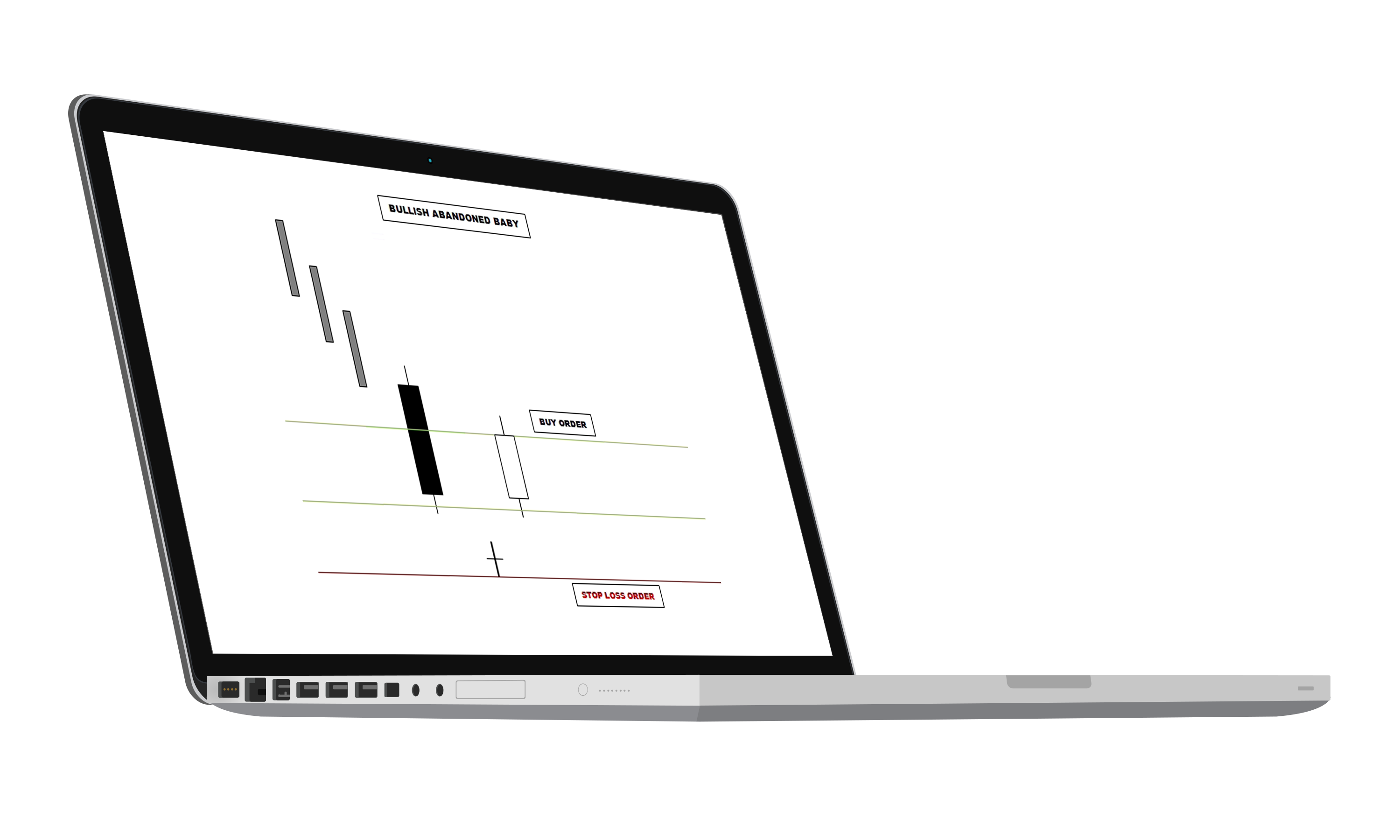

This three-candlestick pattern denotes a significant bottom reversal. With one significant exception, it is exactly the same as the Bullish Morning Doji Star. The shadows of the first and third days must also gap below the shadows on the Doji. It gets its name from the second day of the pattern, which hangs out on the chart by itself like a first- and third-day infant left behind. The pattern basically consists of a black candlestick, a Doji that gaps away from the prior black candlestick (including shadows), and then a subsequent white candlestick whose closing is well inside the first black body.

The Bullish Abandoned Baby must begin with a long black candlestick and end with a Doji that creates a gap away from the previous candlestick (including shadows). The pattern's third day is represented by a white candlestick. You can disregard the distance between the Doji's high and the candlestick's low. The black candlestick that first emerges at the start of the pattern must close deeply into the white candlestick. According to the other candlesticks in the pattern, the height at which this candlestick must close is determined. The conclusion of the third day must fall halfway between the beginning of the first day and the lowest body level of the second day.

The ongoing decline is confirmed to continue by a black candlestick. The Doji's appearance, which creates a wide gap, signals that the bears are continue driving the price lower. The narrow price range between open and close demonstrates uncertainty and worsens the prior trend. The candlestick's body is elevated above the second day on the third day in an effort to make up some of the lost ground from the first day.

The final close is referred to as the confirmation level. For confirmation, prices must cross over this level.

The lowest of the previous two lows is used to define the stop loss level. The stop loss is triggered if, after the BUY, prices fall instead of rising and close below or make two successive daily lows below the stop loss level without the appearance of a bearish pattern.

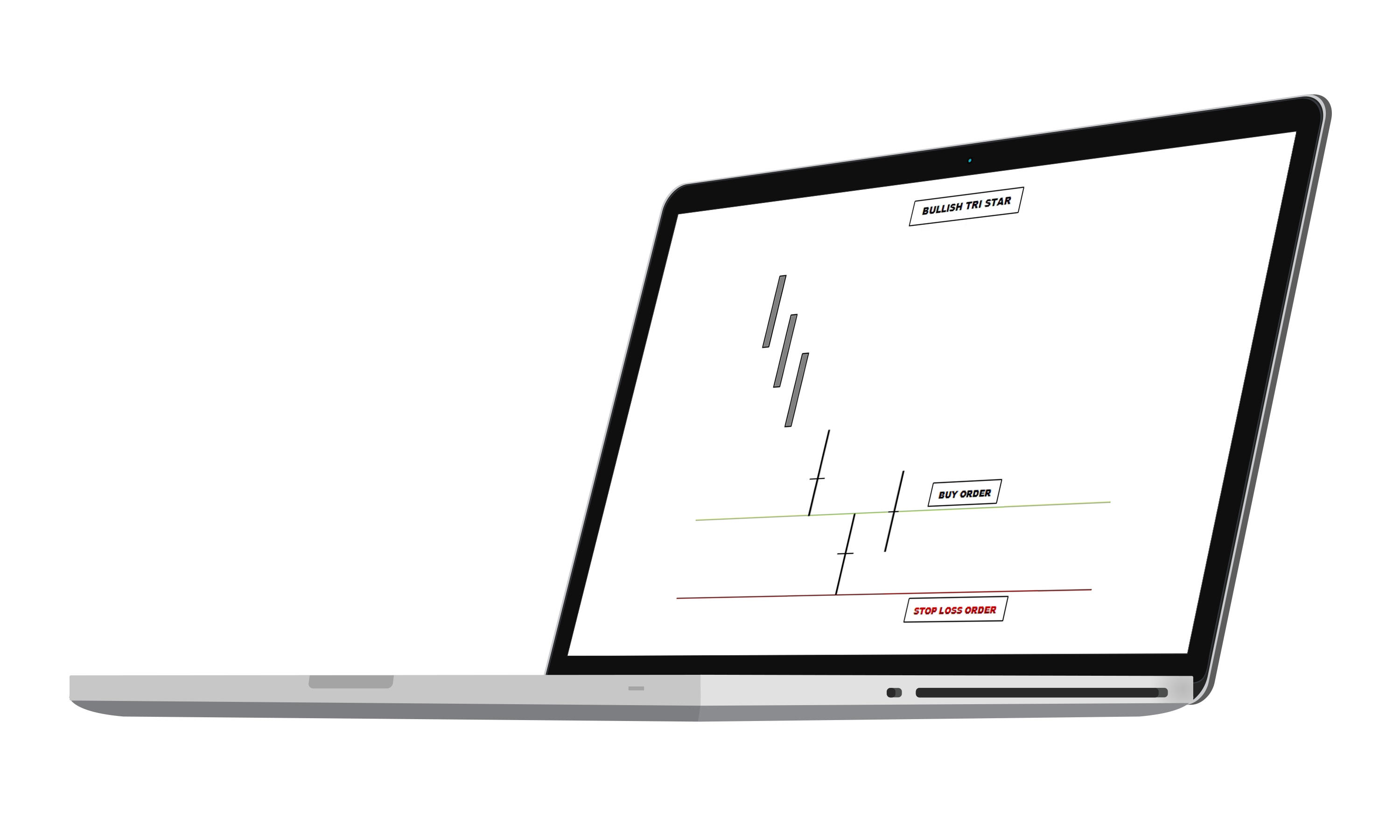

This pattern consists of three Doji in succession. This pattern is highly uncommon, therefore when it does appear, it should not be disregarded.

The second Doji gaps below the other two Doji to form the Bullish Three Star, which comprises of three Doji in a row. The fact that the gap is a body gap suffices. The space between shadows is not necessary.

A market that has been in a decline for a considerable amount of time is necessary for a bullish Tri Star. The smaller bodies, on the other hand, are likely a sign of the deteriorating trend. The initial doji raises some red flags. The market is losing direction, as shown by the second Doji. The third doji signals the end of the downturn towards the end. This pattern suggests a lack of decision-making that caused positions to be switched.

The final close is referred to as the confirmation level. For confirmation, prices must cross over this level.

The lowest of the previous two lows is used to define the stop loss level. The stop loss is triggered if, after the BUY, prices fall instead of rising and close below or make two successive daily lows below the stop loss level without the appearance of a bearish pattern.

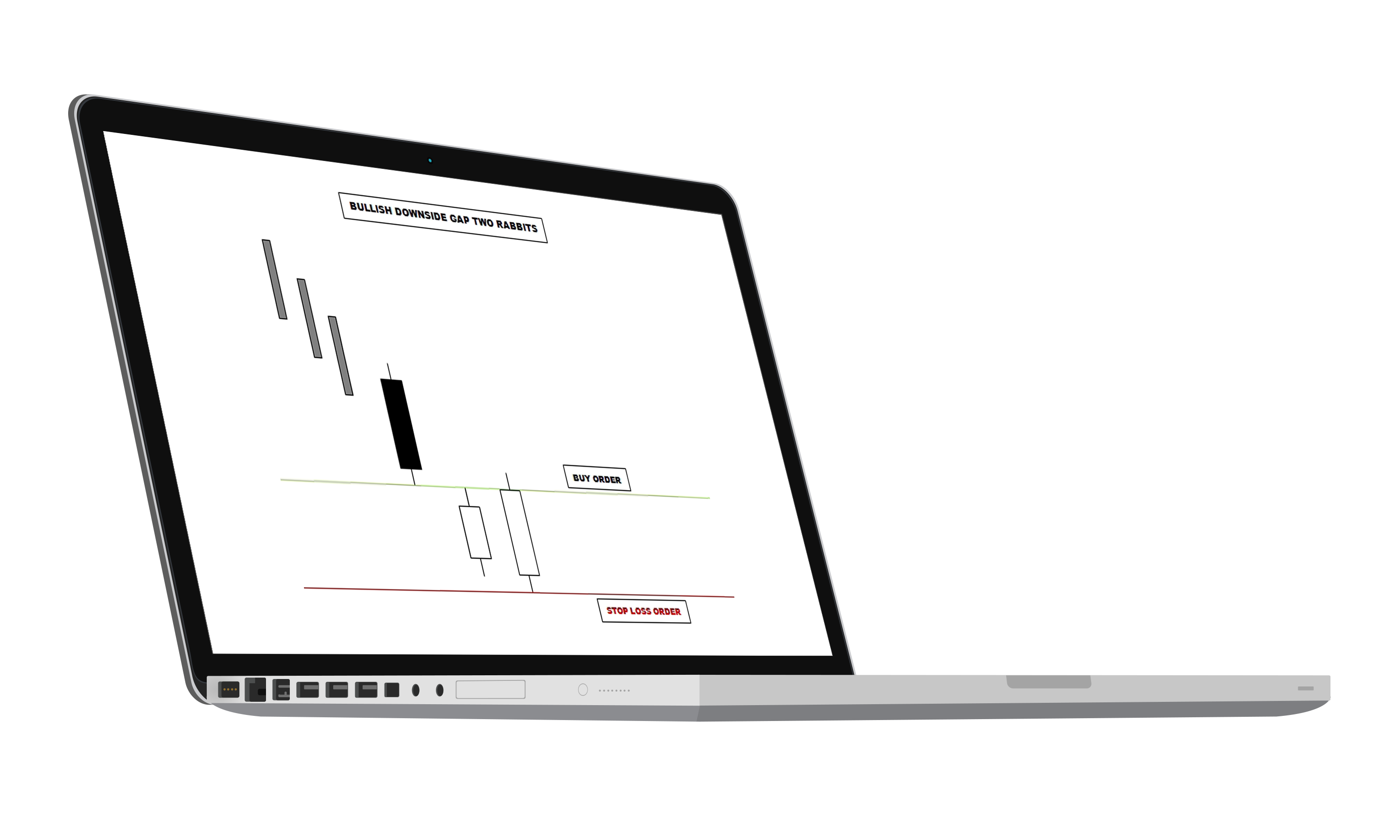

This is a bullish reversal pattern with three candlesticks. The difference between the black body of the first day and the white body of the second day is what is known as the downward gap. The rabbits poised to emerge from their burrow are represented by the white candlesticks of the second and third days.

The Negative Gap Start off with a normal or long black body for Two Rabbits. The next is a short, white body with a body gap at the bottom. The second day is engulfed by the third day, which is another white body. The third day's opening may match or fall short of the second day's opening. The gap between the first and second days should still be unfilled as the third day should end below the first day's body limits.

The black candlestick intensifies the previously existing bearishness, which has been a decline. The next day's opening has a gap that is lower. Prices begin to climb slightly, and a brief white candlestick is seen. Even if a white body appears on this day, prices fail to close higher than the closing of the day before, thus the bears are not frightened. The third day begins at or below the second day's start but rebounds throughout the day to close higher than the first day's close. The two successive white bodies indicate that there have been doubts raised about the downtrend's strength.

The final close is referred to as the confirmation level. For confirmation, prices must cross over this level.

The previous low is referred to as the stop loss level. The stop loss is triggered if, after the BUY, prices fall instead of rising and close below or make two successive daily lows below the stop loss level without the appearance of a bearish pattern.

This three-candlestick motif resembles the Bullish Morning Star in certain ways. It appears to be declining. The next little black body, which typically has a lengthy lower shadow, is engulfed by the first day's black candlestick. A little white body that closes below the close of the second day completes the pattern.

A brief black candlestick that opens higher must come after the strong black candlestick that signals the beginning of the Bullish Unique Three River Bottom. A long lower shadow that extends lower than the low of the first day results from the second day's trading at a new low. By the first day, the body of this candlestick ought to be submerged. The third and final day of the pattern must include a brief white body that is lower than the body of the second day.

The market is testing new lows, and a bad day results from it. Unexpectedly, the next day begins higher; but, the bears demonstrate their might and cause fresh lows to be achieved during the day. The day ends close to where it began, which causes a brief black candlestick to develop. The effectiveness of the bears is in doubt, and the market is characterised by uncertainty. The bears are weakening when a tiny white body shows up the following day.

The final close is referred to as the confirmation level. For confirmation, prices must cross over this level.

The lowest of the previous two lows is used to define the stop loss level. The stop loss is triggered if, after the BUY, prices fall instead of rising and close below or make two successive daily lows below the stop loss level without the appearance of a bearish pattern.

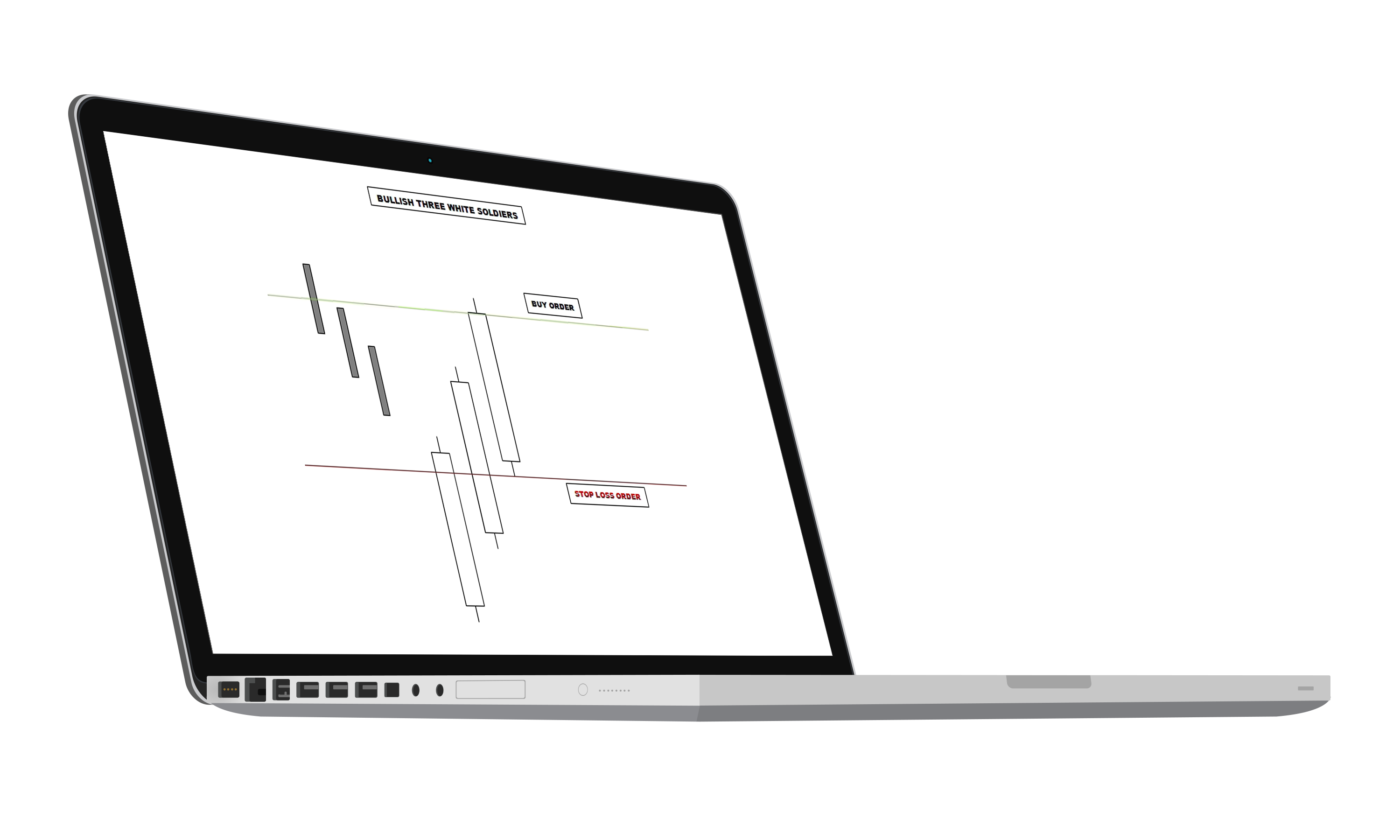

This pattern predicts a significant market reversal. Three regular or long candlesticks that are incrementing upward are what give it away. Each day's beginning is a little lower than the previous close, and prices gradually close at higher levels. This staircase-like behaviour denotes a trend reversal.

A series of three consecutive normal or long white candlesticks is known as the Bullish Three White Soldiers. The final two candlesticks must start in the previous candlestick's range and end higher.

The pattern develops when the market has been stacked at a low price for an extended period of time. The market is either nearing or has already reached a bottom while continuing to test fresh lows. The first white candlestick serves as proof of a further, determined upward attempt. The next two days will see a continuation of the rally with higher closing. Now, bears must cover short positions.

The final close is referred to as the confirmation level. For confirmation, prices must cross over this level.

The previous low is referred to as the stop loss level. The stop loss is triggered if, after the BUY, prices fall instead of rising and close below or make two successive daily lows below the stop loss level without the appearance of a bearish pattern.

Three consecutive black candlesticks with lower closes in a downtrend make up this pattern. The Bearish Deliberation Block Pattern is complimented by it.

It is not advisable to short the first two black candlesticks that occur in the Bullish Deliberation Block. The end of the second day should be at or below the close of the first day, and the second day should open at or higher than the close of the first day. A short black candlestick or a Doji can fill the space left by the gaping third candlestick.

The downtrend is confirmed by two consecutive black candlesticks, and the bears are happy with the state of affairs. More bears are drawn to the secure decline, and the third day opens below the close of the first. The third day is likewise a down day, which persuades the bears that the downtrend will continue. However, a deeper inspection reveals indications of vulnerability. Each body's range is reducing day by day, and the third day gaps below form a star, indicating indecision.

The halfway between the previous close and the second day's body bottom is known as the confirmation level. For confirmation, prices must cross over this level.

The lowest of the previous two lows is used to define the stop loss level. The stop loss is triggered if, after the BUY, prices fall instead of rising and close below or make two successive daily lows below the stop loss level without the appearance of a bearish pattern.